Lots of credit applications on your record can make you look desperate for credit, which can negatively impact your rating. If you’re rejected for business credit, don’t immediately apply to another lender. Limit credit applications – try to avoid making lots of credit applications in a short period. Pay your bills on time – pay your bills and invoices on time and keep up with any credit repayments to avoid negatively affecting your credit rating.Ĭlose accounts you no longer need – if it looks like you have lots of credit available in multiple accounts, this may weaken your business credit score. You might also consider having your accounts audited to give you peace of mind that there aren’t any mistakes in your reports. Filing late can give the impression to lenders that you’re struggling financially. You might also want to consider taking out business credit, like an overdraft and a business credit card, to establish your business credit score – but it’s important to always make sure you’ll be able to keep up with repayments.įile on time – make sure you submit your accounts to Companies House and file returns before the deadline. Open a business bank account - if you haven’t already, open a business bank account in your business’s name.

Look into your score before you need to apply for credit to see if there’s anything that you might need to dispute or have corrected. These are some things you can do that may help to improve your credit score.Ĭheck your credit rating – incorrect information on your credit report can give lenders the wrong impression and might affect your credit score.

#Check my business credit score how to#

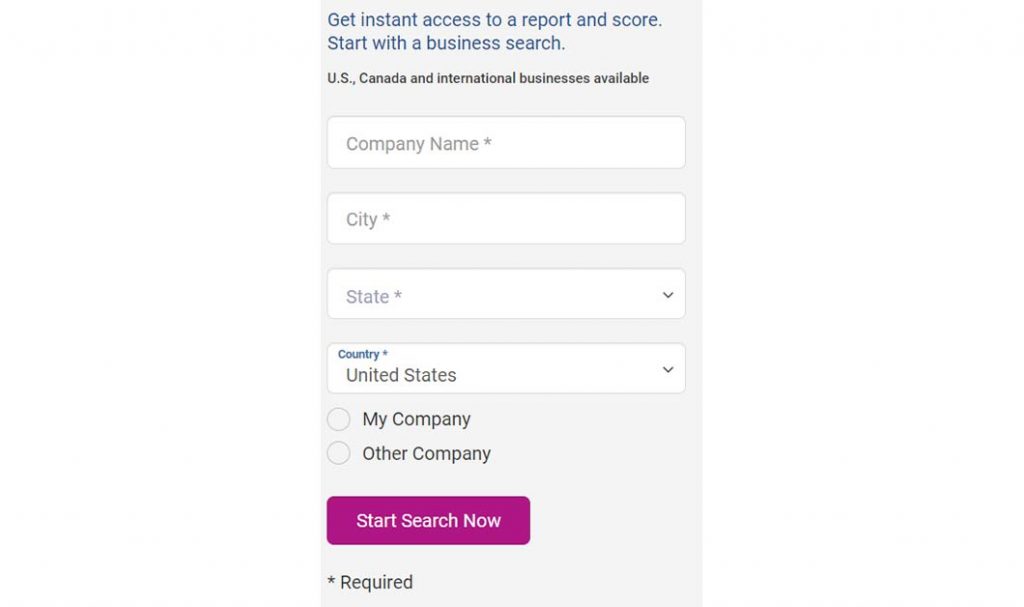

How to improve your credit score for your business This can include:Īny people you’re ‘financially linked’ to – for example if you have a business partner, their credit history can impact your business credit score To check a business credit score, CRAs collect information from your application form, as well as public records and companies you have relationships with. What do referencing agencies know about you? They have a subscription model for viewing your business credit report, and you can sign up for monthly access for £24.99 (+VAT). There are three main credit referencing agencies (CRAs) in the UK: Experian, Equifax, and TransUnion.įor example, you can access your Experian business credit score online. They may send your report in the post, or they may give you access to your credit score via an online account. To find out your business credit score, you need to contact one of the business credit reporting companies. Different lenders will use different credit reporting companies when they’re checking your credit score. There are several credit reporting companies and each company uses its own methods and scoring system. It’s important to understand that your business doesn’t have a single business credit score. How to check credit score for your business If you have a good business credit score, you’re likely to find it easier to get credit and you may be offered more competitive interest rates. Or if you do manage to find finance, you may be offered very high interest rates. If you have a poor business credit score – for example if your business has missed loan repayments in the past or you’ve made several failed credit applications – you may struggle to access finance for your business.

It can also impact the rates you’re offered. If you’re opening a business bank account, applying for a business loan, or even just arranging a mobile phone contract, your business credit score may affect whether your application will be accepted. Whereas if you have a score closer to zero, you’d struggle to get credit. You want to have a score closer to 100, as a high score indicates creditworthiness and therefore a low risk to lenders. They’re a measure used by lenders to decide whether businesses will be able to manage repayments.

Like personal credit scores, business credit scores are based on financial history.

0 kommentar(er)

0 kommentar(er)